Operating in a high-risk industry? You know the struggle. Traditional payment processors often shy away from businesses like yours, leaving you with limited options and stifled growth. But fear not, for Highriskpay.com is here to change the game.

They are a specialized provider of high-risk merchant accounts, dedicated to empowering businesses like yours to thrive. They understand your unique challenges and offer a comprehensive suite of services designed to streamline your operations and ensure smooth, secure payment processing.

Industries High Risk Pay Support:

- Adult Merchant Account

- Bad Credit Merchant Account

- CBD Merchant Account

- Debt Collection Merchant Account

- Continuity Subscription Merchant Account

- Credit Repair Merchant Account

- Dating App Merchant Account

- Ecommerce Merchant Account

- Firearm Merchant Account

- High Volume Merchant Account

- MLM Merchant Account

- Online Pharmacy Merchant Account

- Startups Merchant Account

- Tickets brokers Merchant Account

- Travel Merchant Account

- Tech Support Merchant Account

- Dropshipping Merchant Account

- Nonprofits Merchant Account

- Sportsbook Merchant Account

- Nutraceutical Merchant Account

What Does Highriskpay.com Offer?

- Fast and Easy Approval: Unlike traditional processors, they boast a 99% approval rate and a streamlined online application process. Get started quickly and eliminate unnecessary delays.

- Seamless Integration: They integrate seamlessly with your existing website or shopping cart, ensuring a user-friendly experience for your customers.

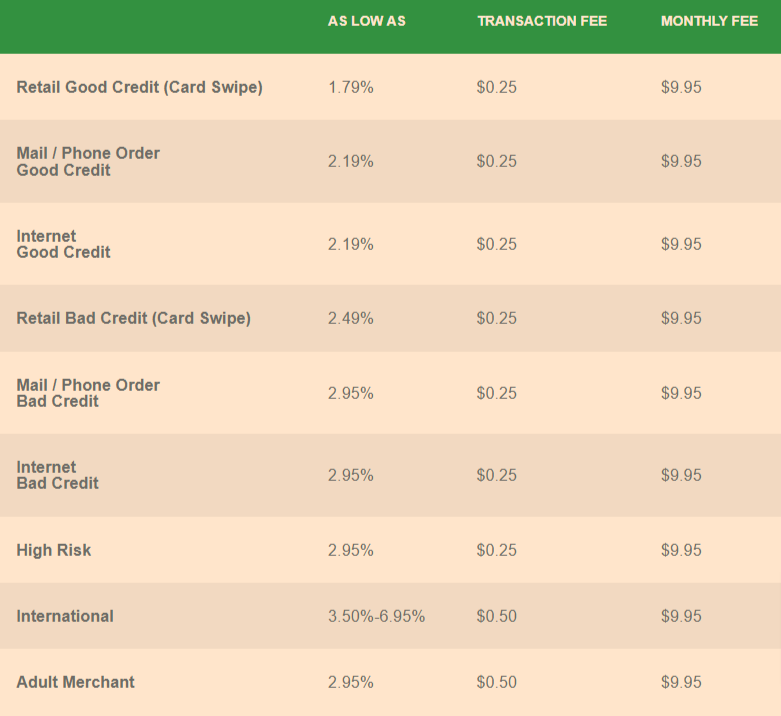

- Credit Card Processing: Accept all major credit cards with competitive rates and transparent fees.

- Advanced Chargeback Management: Our dedicated team helps you minimize chargebacks and protect your revenue.

- Robust Fraud Prevention: Highriskpay.com utilize industry-leading security measures to combat fraud and keep your transactions safe.

- ACH/eCheck Processing: Offer your customers a convenient and cost-effective alternative to credit cards.

- International Processing: Expand your reach and accept payments from customers around the world.

- High-Risk Industry Specialization: They have extensive experience working with businesses in various high-risk industries, such as adult entertainment, travel, nutraceuticals, and more.

But that’s not all. Highriskpay.com also offer:

- Dedicated Account Manager: You’ll have a personal point of contact for any questions or concerns.

- 24/7 Customer Support: They are always available to assist you, no matter the time or day.

Why Choose Highriskpay.com?

- Unmatched Expertise: Highriskpay.com have years of experience serving high-risk businesses and understand the unique challenges you face.

- Fast and Easy Setup: Get your account up and running quickly and easily with our streamlined application process.

- Competitive Rates and Fees: They offer transparent and competitive pricing, so you know exactly what to expect.

- Exceptional Customer Service: They are committed to providing you with personalized support and assistance every step of the way.

- Industry-Leading Security: Your data is safe with them. They utilize the latest security technology to protect your transactions and ensure compliance with all relevant regulations.

Highriskpay.com Account Application Documents:

To apply for a high-risk merchant account with highriskpay.com, you will need to provide the following documentation:

1. Business Registration and Tax Documentation:

- Articles of incorporation or other business registration documents

- Business licenses and permits

- Tax identification numbers (EIN, VAT number, etc.)

2. Bank Statements:

- Several months of bank statements (typically 6 months)

- Statements demonstrating financial stability and ability to process payments

3. Processing History (if applicable):

- Documentation of processing history with another provider

- Chargeback ratios and other relevant information

4. Website and Marketing Materials:

- Website URL or access to the website itself

- Marketing materials showcasing business model and target audience

- Must comply with highriskpay.com’s underwriting criteria

5. Identity and Address Verification:

- Government-issued photo ID (passport, driver’s license, etc.)

- Proof of address (utility bill, bank statement, etc.)

The process of opening a high-risk merchant account

Here’s how opening a high-risk merchant account with them works:

1. Application: You submit an application, providing information about your business.

2. Assessment: Highriskpay.com evaluates your application to determine your risk level.

3. Approval (If successful): You receive a merchant account and start processing credit card payments.

4. Integration: You integrate the payment solution into your website/payment process.

5. Payment Processing: Highriskpay.com handles transaction processing, including security and fraud monitoring.

6. Fund Deposit: Your transaction funds are deposited into your account.

Keep in mind: High-risk merchants may face higher fees and stricter regulations than regular merchants.

Don’t let the challenges of being a high-risk business hold you back. Contact Highriskpay.com today and let them help you achieve your financial goals. Highriskpay.com offer a free consultation to discuss your specific needs and answer any questions you may have.